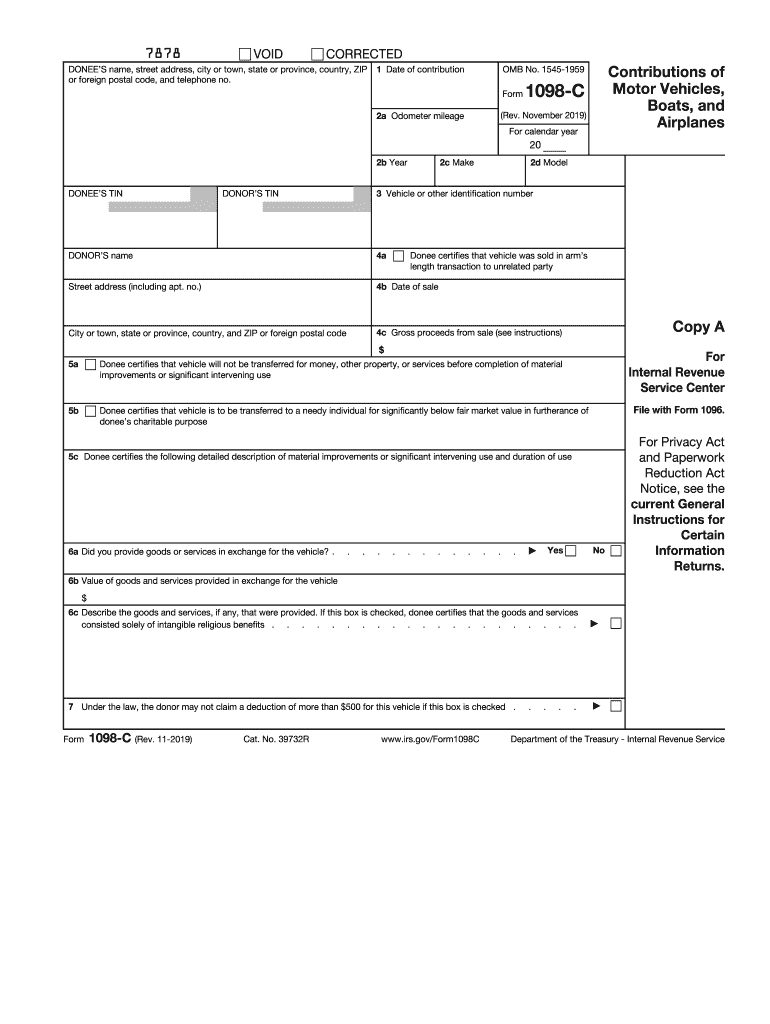

What is form 1098C?

Form 1098-C is filed by a charitable organization to report a qualified vehicle that was donated to the organization and valued over $500. A qualified vehicle can be one of the following:

- A car designed for use in the public streets, highways, and roads

- A boat

- An airplane

The form is filed to the IRS by the charitable organization and sent to the donor no less than 30 days after the donation was made. Donors need to include Copy B of form 1098-C with their tax returns to claim a deduction if the charitable organization valued and sold the vehicle for over $500.

Who should file form 1098C?

Any charitable organization that has accepted a qualified vehicle for its own use on a free-of-charge basis.

What information do you need when you file form 1098-C?

To fill out this form, you must complete the 1096 form. After that, you have to add the following information to the 1098-C form:

- Charitable organization’s information and TIN

- Donor’s information and TIN

- Details of the contribution (date, mileage, year, make/model)

- Value of property given by the donor

- Date and gross proceeds of sale

- Specification that value of the property is at least $500

Any failure in providing the information of the charitable organization or the donor may lead to varying penalties. You can find more detailed instructions on page 4 (for donors) and page 6 of the form (for charitable organizations or “donees”).

How do I fill out form 1098-C in 2024?

You can easily complete 1098-C online, and pdfFiller will send it via USPS for you. To fill out 1098-C, take the following steps:

- Click Get Form to open 1098-C in pdfFiller.

- Fill out and sign the form.

- Click Done.

- Click Send via USPS.

- Fill in mailing information.

- Select delivery terms.

- Click the Send button.

pdfFiller will print and deliver the form to the post office quickly.

Is form 1098-C accompanied by other forms?

The 1098-C tax form is filed with form 1096. It may also be accompanied by a 170(f)(8) application.

When is form 1098-C due?

The IRS form 1098-C must be filed by the charitable organization 30 days after the donation. A copy of it must be provided to the donor.

Where do I send form 1098-C?

The completed 1098-C form must be attached to the 1096 form and sent to the Department of the Treasury, Internal Revenue Service.