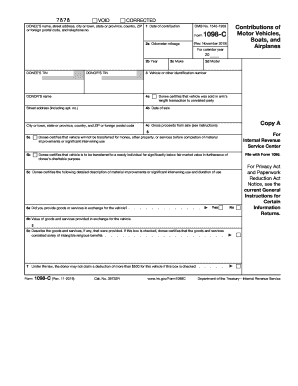

IRS 1098-C 2025-2026 free printable template

Instructions and Help about IRS 1098-C

How to edit IRS 1098-C

How to fill out IRS 1098-C

Latest updates to IRS 1098-C

All You Need to Know About IRS 1098-C

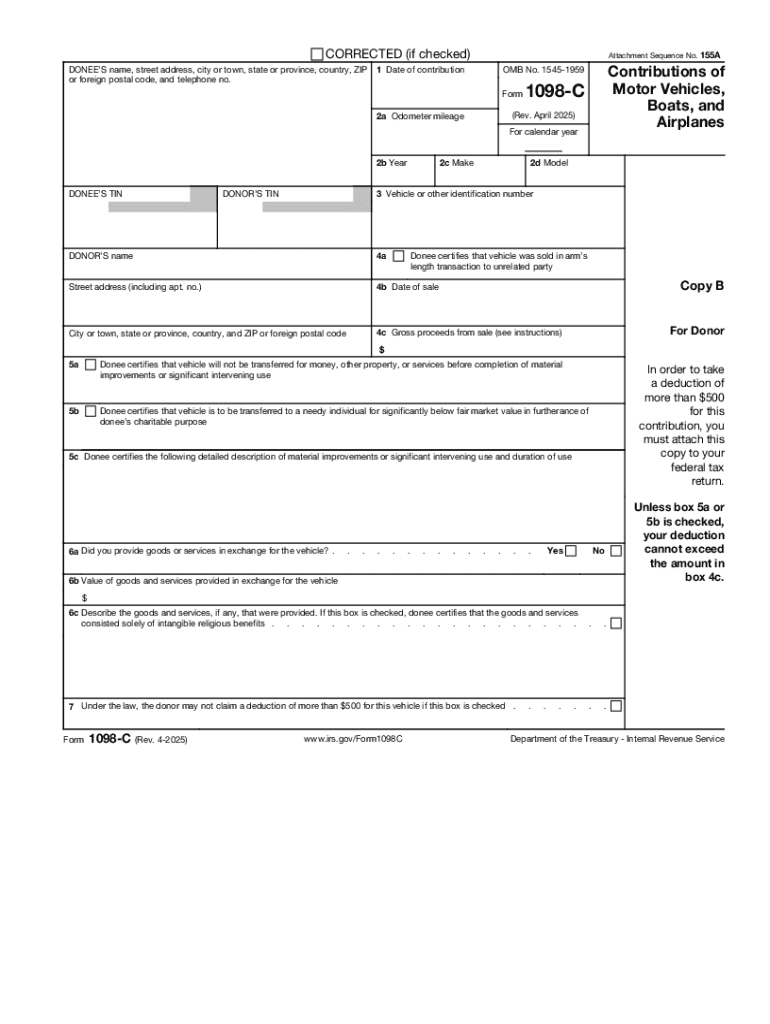

What is IRS 1098-C?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1098-C

What should I do if I need to correct a mistake after filing IRS 1098-C?

If you discover an error after submitting your IRS 1098-C, you should file an amended form. This can be done by submitting a corrected version of the IRS 1098-C along with any necessary explanations. It's important to do this promptly to avoid complications with tax reporting for both you and the recipient.

How can I verify the status of my filed IRS 1098-C?

To verify the status of your IRS 1098-C, you can contact the IRS directly or check using the IRS online tools available for taxpayers. Common e-file rejection codes may also provide insight into any issues that might have occurred during submission, and it’s advisable to keep a close eye on your filing status post-submission.

What are some common errors to avoid when filing the IRS 1098-C?

Some common errors when filing IRS 1098-C include incorrect recipient information, errors in the amount reported, or failing to meet filing deadlines. Double-checking details against your records and ensuring compliance with IRS instructions can help mitigate these mistakes.

Can I e-file the IRS 1098-C, and what are the technical requirements?

Yes, you can e-file the IRS 1098-C, but make sure your software is compatible with the IRS requirements for electronic submissions. This includes ensuring that you are using the right format and that your system meets any specific technical specifications outlined by the IRS for e-filing.

See what our users say